Posted on: April 13, 2023 by Huntersure

Product design is an essential part of getting new products off the ground and into the hands of consumers. While some companies manage this task internally, others turn to product design firms to create the most efficient devices possible. While running such a firm can be lucrative, unique risks accompany third-party design services. As an insurance agent, you can help these companies protect themselves from liability with the right insurance plan.

Any business that provides product design for a third party needs professional liability insurance. Of course, some companies may not feel that way, especially when measuring the premium against their budgets. However, you can help them understand what’s at stake by explaining policy benefits.

When product design firms take on a project, they enter into a contract with their clients. Violating said contract, whether willful or not, can have monetary and legal consequences. In addition to paying a settlement, the firm may experience damage to its reputation, making it more difficult to get future projects.

A professional liability policy, you can explain, will safeguard companies from the financial fallout of a contract violation. This insurance covers several common concerns:

You can also point out that many clients will only work with uninsured firms if it poses a significant risk.

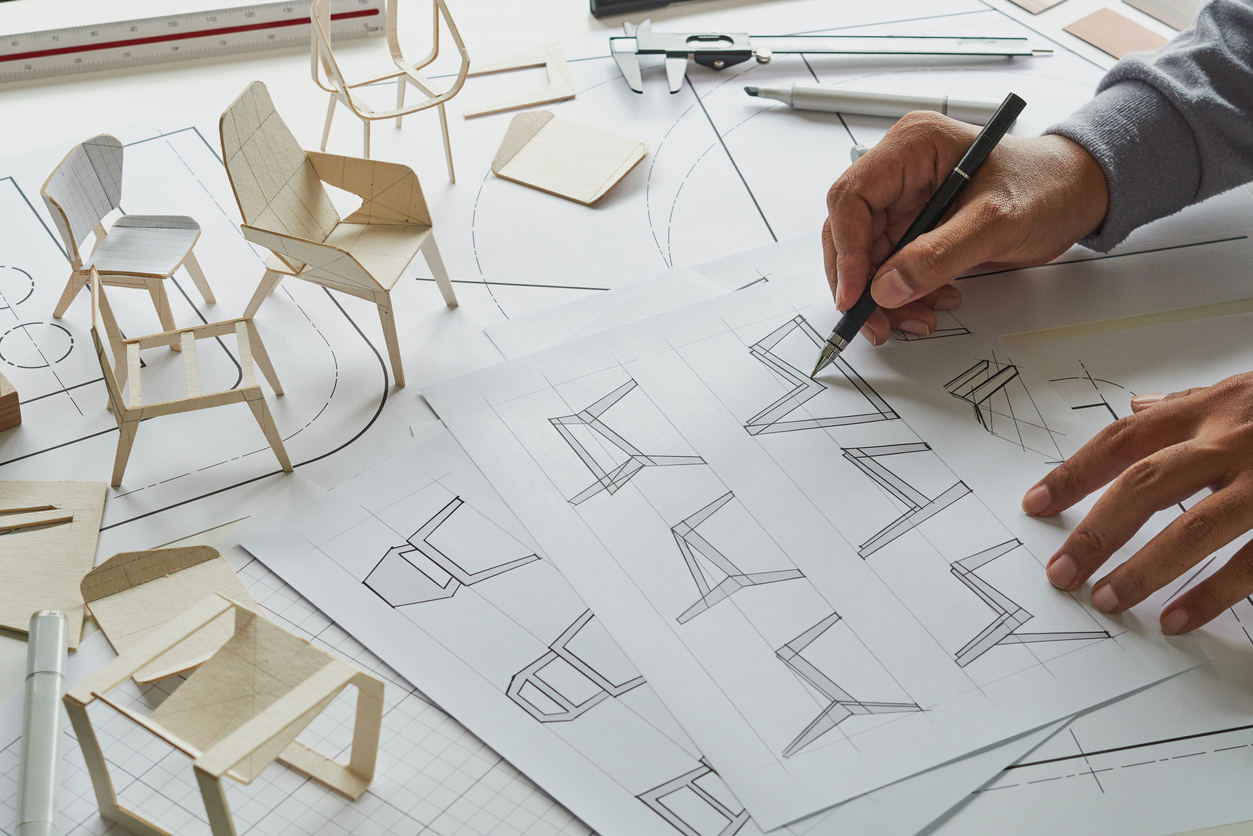

Product definition is one of the essential things to highlight when discussing how to thrive as a product design firm. During this stage, designers conceptualize possible features to make the product more attractive to consumers. To do so, they must consider three factors;

Desirability is what draws consumers to purchase the product. Consumers judge a book by its cover, so outdated or unappealing aesthetics decrease a tool’s chance at commercial success.

Of course, product design firms can’t sacrifice functionality or usability for aesthetics — if a product doesn’t work, it won’t last on the market. The three factors must work together to create an overall more effective design.

Every business should analyze its risks and create a mitigation plan. Doing so can save money on settlements, legal fees, and recalls. It can also help companies avoid the hits to their reputations.

Risk assessment has three steps:

No company is entirely risk-free, though the severity varies by industry. Most companies have some degree of risk in the following sectors:

For design firms, risk has another meaning. To develop a product, companies must review the design for any dangers. For example, if the end product is a toy, does the design present choking hazards? A minor adjustment to the shape or function can serve as the difference between life and death.

As an agent that serves product design firms, you can communicate the many benefits of risk assessment, such as lower insurance rates. You can also offer policies that address the most prominent concerns.

Huntersure LLC is a full-service Managing General Agency that has provided insurance program administration for professional liability products to our partners across the United States since 2007. We specialize in providing insurance solutions for businesses of all sizes. Our program features can cover small firms (grossing $2.5 million annually) to large corporations (grossing $25 million annually or more). We make doing business with us easy with our breadth and depth of knowledge of E&O insurance, our proprietary underwriting system that allows for responsive quoting, binding and policy issuance and tailored products to meet the needs of your insureds. Give us a call at (855) 585-6255 to learn more.

Posted in: Product Design Product Design Liability